There has been surprisingly very little mathematical analysis on passive investing's actual impact, and a consensus on its volatility does not exist. For example, can the current low VIX be attributed to the growing share of investments represented by passive investing?

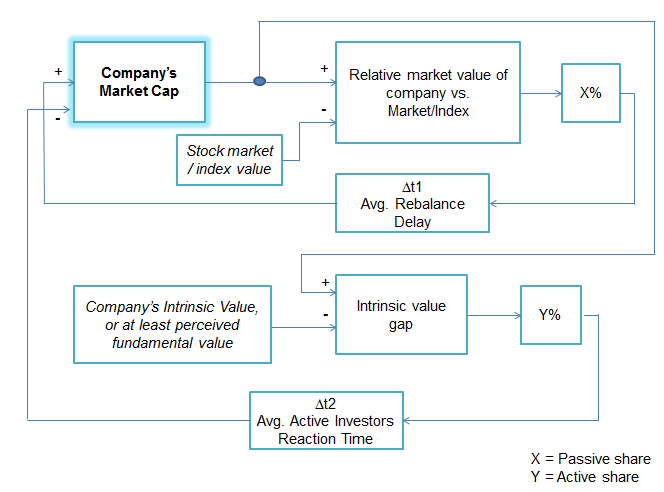

Let's start by tackling the question of whether passive investing makes markets more or less stable. The best approach to analyse this problem is probably to use flow dynamics. The below figure illustrates that if X (= passive market share) is 100%, a company that outperforms the market during Delta t1 period would get more than its previously weighted share of investments, resulting in an above market gain, meaning that in the next round of investments it would again get more proportionate investments. An important observation to make is that its weight in the overall market value would increase too. The end result would be that the best performing stock becomes even more important, gaining more market share, reducing the number of companies competing for investment until the entire market becomes just one company.

Figure 1.

This sounds crazy, but it is a recognised instability effect introduced by positive feedback loops. It can be argued that FAANG stocks outperformance can be, at least in part, attributed to this positive feedback effect. If index investing were to represent 100% of investments, only one of the FAANG stocks would survive, with all others becoming unsustainable. Jack Boyle, founder of Vanguard, believes passive investing has a limit at about 75%. If index investing introduces instability, why has the VIX trended down? An important reason is that passive reaction time Delta t1 is slower than for active investors, so market moves take longer to play out as “passive” gains market share, and daily movements are more muted. It's also important to remember a lesson from engineering: phase delays can change whether two signals add or substract from each other. In real life this can mean that by the time active investors realise they took the price of a stock too far (e.g. after a positive earnings announcement) and start selling, the passive investors will just be starting their rebalancing and will be buying from them, effectively dampening the correction and reducing volatility. This of course can also happen in the opposite direction. It is therefore difficult to determine a threshold to how much the passive share can grow, since it depends on other factors such as Delta t1 and Delta t2, and how disciplined active investors are in allocating funds based on intrinsic value vs. following the trend. Based on how many active investors are currently over-allocating FAANG stock, we dont expect intrinsic value discipline to be strong, unfortunately. Theoretically, Sharpe's equality says that passive investors get average returns, while active investors battle each other for alpha, but still also get average returns as a group, with higher fees. This is a good approximation when the passive share is small, however as it gains share active investors will front-run them when they rebalance, effectively adding an invisible fee to passive investors. This has been clearly observed in commodity ETFs, for example. Passive investing has many merits and is certainly bringing benefits to investors. However, it must be acknowledged that it also introduces market inefficiencies that could result in a breakdown of the market if the passive share grows too large. A factor that will help push passive market share down will be the increasing “rebalance tax” investors following that strategy will have to pay to active investors. Other factors are company takeovers or aggressive share buy-backs when companies are significantly under-valued, or significant stock issuance when over-valued. If this theory is correct market returns will come from fewer and fewer stocks as the passive market share increases. For investors this means that while indexes might keep posting records, some companies will be in a bear market. Portfolios will have fewer, more extremenly overvalued companies, and more and more undervalued companies at the same time.